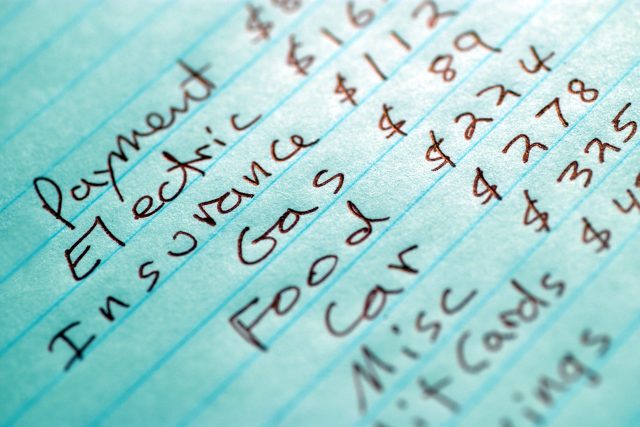

The whole purpose of a budget is to lay everything out in front of you so you can see where everything is going and make some tweaks if you're not currently on course to meet your goals. But creating a budget happens to be the one step that makes every other financial goal reachable.Ī budget is a line-item accounting of all your income - salary, maybe a side gig, perhaps income from an investment - and all your expenses. Save for a child's (or grandchild's) education in a tax-advantaged 529 Plan.

Longer-term goals: Start saving at least 10% of gross salary every year for your retirement.Keep new credit card charges limited to what you can pay off, in full, each month. Short-term goals to reach in the next year or so: Build an emergency fund that can cover at least three months of living expenses.Here's a simple prompt: Money-wise, what would make you feel great? At its heart, that's what a financial plan delivers: the means to help you feel safe and secure, so you can focus on living, not worrying. Just be sure to give yourself some quiet time to think it through. It's up to you whether your list of short- and long-term goals is on a spreadsheet or pencil to paper. It's always easier to plot a course of action when you are clear on what you're looking to achieve. Other goals might have an end date that is a decade, or decades, off but require starting sooner than later.Ĭreating a master list of all your goals is a smart first step. Some of the money balls you have in the air are going to be goals you want to reach ASAP. Building financial security is an ongoing juggling act.

0 kommentar(er)

0 kommentar(er)